update on mn unemployment tax refund

They have about. To be sure you receive year-end tax information IRS Form 1099-G update your address now.

Minnesota Business Taxes Spike After Legislature Misses Deadline Minneapolis St Paul Business Journal

Now after the Federal and State updates my State AGI is 3378200 My MN taxable Income is 1002400 and my refund amount is 10500.

. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. As far as Minnesota is concerned per the Minnesota Department of Revenue website they have started processing refunds this month. Irs Tax Refund 2022 Unemployment.

However as the bill was only signed in March millions of taxpayers had already filed tax returns and paid any tax due by. My adjusted Gross Income was 4128300 my Minnesota taxable Income was 364800 and my Refund amount was 44800. Get market news worthy of your time with Axios Markets.

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. Thats the same data. The Minnesota State Capitol in Saint Paul Minnesota.

The agency issued tax refunds worth 145 billion to over 118 million households as of Dec. The Center Square The Minnesota Department of Revenue will start sending out more than 540000 tax returns impacted by tax law changes to Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness. Up to 10200 of the benefits didnt count as income under the American Rescue Plan meaning taxpayers didnt have to pay federal tax on them.

Minnesota Law 268057 Subd7. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. Subscribe for freeWhats happening.

Adjusted about 540000 Individual Income Tax returns and issued refunds to taxpayers affected only by the UI and PPP changes. Box your address should include PO. In the latest batch of refunds announced in November however the average was 1189.

If a credit cannot be used a refund will be paid. The IRS will continue the process in 2022 focusing on more complex tax returns. The tax rate usually goes from 01 up to a maximum of 9 of those wages but due to a covid related shortfall in the unemployment trust fund there is a 158 additional assessment of tax in 2022.

Thousands of Minnesota taxpayers are getting refunds worth an average of 584 each Credit. The federal tax code counts jobless benefits. Here are my Minnesota numbers prior to the Federal Unemployment exclusion.

State officials say refund checks should start going out this week to roughly half-a-million Minnesota taxpayers who filed returns before the legislature passed a law affecting COVID unemployment insurance benefits and businesses Paycheck Protection Program payments making them exempt from Minnesota income tax. But a lot of people still. Hello Since you were able to get through to the IRS and they stated that your refund is processing there isnt much more you can do at this point.

People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds the IRS said in a press release. Businesses that received forgivable payroll loans from the federal government and Minnesotans who got extra jobless benefits last year will begin seeing state tax refunds in the next few weeks. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000.

September 15 2021 by Sara Beavers. We know these refunds are important to those taxpayers who have. Tax season started Jan.

You can update your address online or by calling Customer Service. As of January 27 2022 we have. Working through the summer and early fall to update 2020 tax forms to reflect the law changes made in July.

The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion. Employers that overpay their unemployment insurance tax amount due for a quarter can request a credit adjustment within four years from the date the tax payment was originally due. The IRS has sent 87 million unemployment compensation refunds so far.

If you received unemployment in 2020 the federal government decided up to 10200 of that money would be tax free to help people out during the pandemic. Minnesota to process refunds for unemployment insurance paycheck protection program. On Thursday September 9 th the Minnesota Department of Revenue announced the processing of returns impacted by the tax law changes made for the treatment of unemployment insurance compensation will begin the week of September 13 th.

Weve finished adjusting 2020 Minnesota tax returns affected only by law changes to the treatment of Unemployment Insurance UI compensation and Paycheck Protection Program PPP loan forgiveness. The Minnesota Department of Revenue. Company A has 5 employees that earn 80000year.

Minnesota Unemployment tax is paid on the first 38000 2022 of wages paid to MN workers. 24 and runs through April 18. We know these refunds are important to.

Update your address for year-end tax mailing - IRS Form 1099-G. Unemployment benefits are taxable income under both federal and Minnesota laws. Federal and MN State unemployment tax refund.

- The Minnesota Department of Revenue announced today that the processing of returns impacted by tax law changes made to the treatment of Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness will begin the week of September 13. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. Credit adjustments refunds.

September 13th 2021. Most taxpayers will receive their unemployment refunds automatically via direct deposit or paper check. For step-by-step instruction to request a credit adjustment and.

The unemployment tax break provided an exclusion of up to 10200. If you have a PO. Minnesota Unemployment Refund Update.

Refunds for about 550000 filers who paid state taxes on the extra 300 and 600 unemployment payments. Households waiting for unemployment tax refunds will be unhappy to know that 436000 returns are still stuck in the irs system. The Minnesota Department of Revenue has started processing Unemployment Insurance and Payback Protection Program PPP refunds.

Minnesota State Tax Refund Mn State Tax Brackets Taxact Blog

Federal Rescue Dollars To Start Flowing To Minnesota This Week Mpr News

Bug Mn Non Resident Income Incorrect

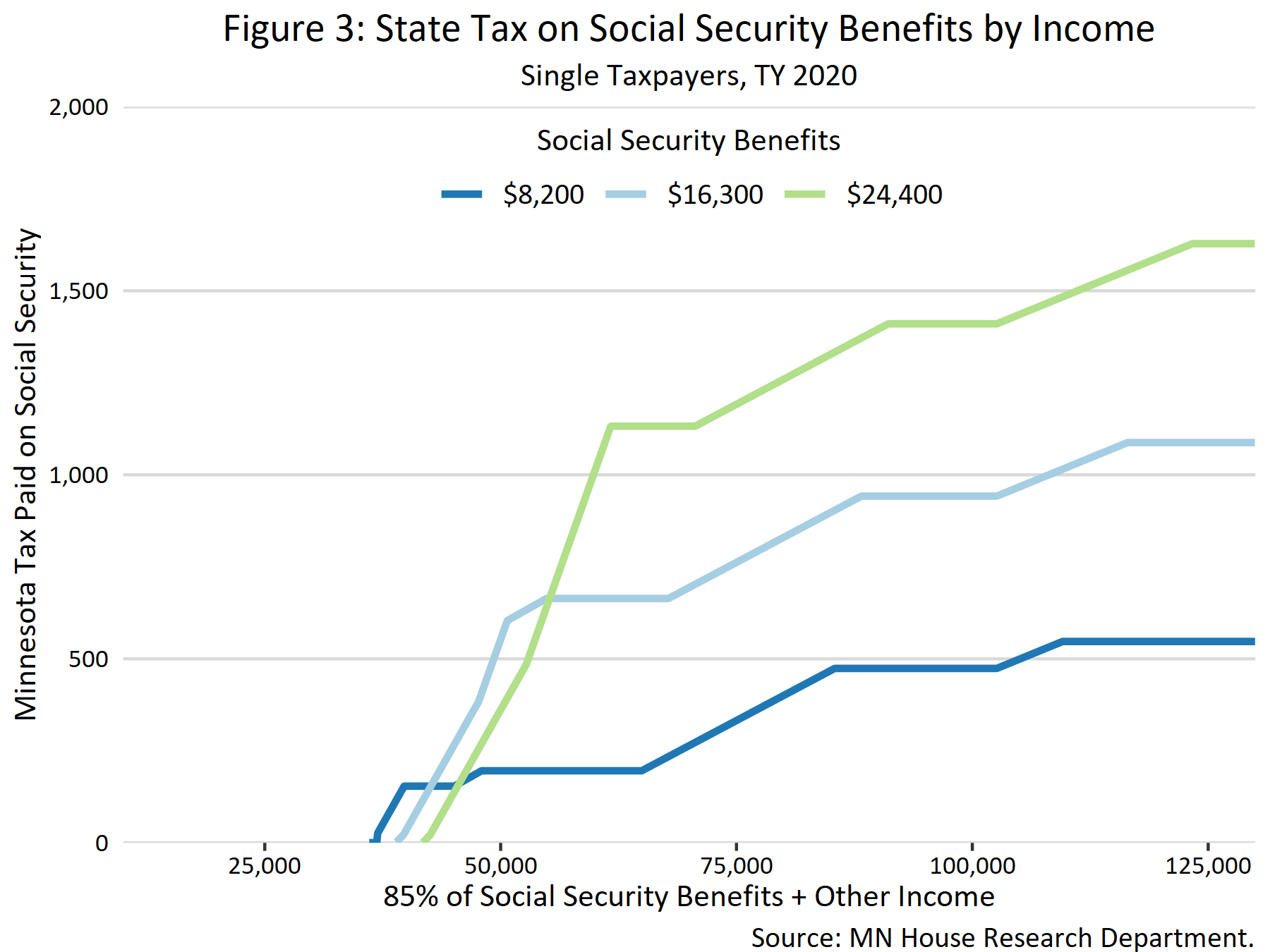

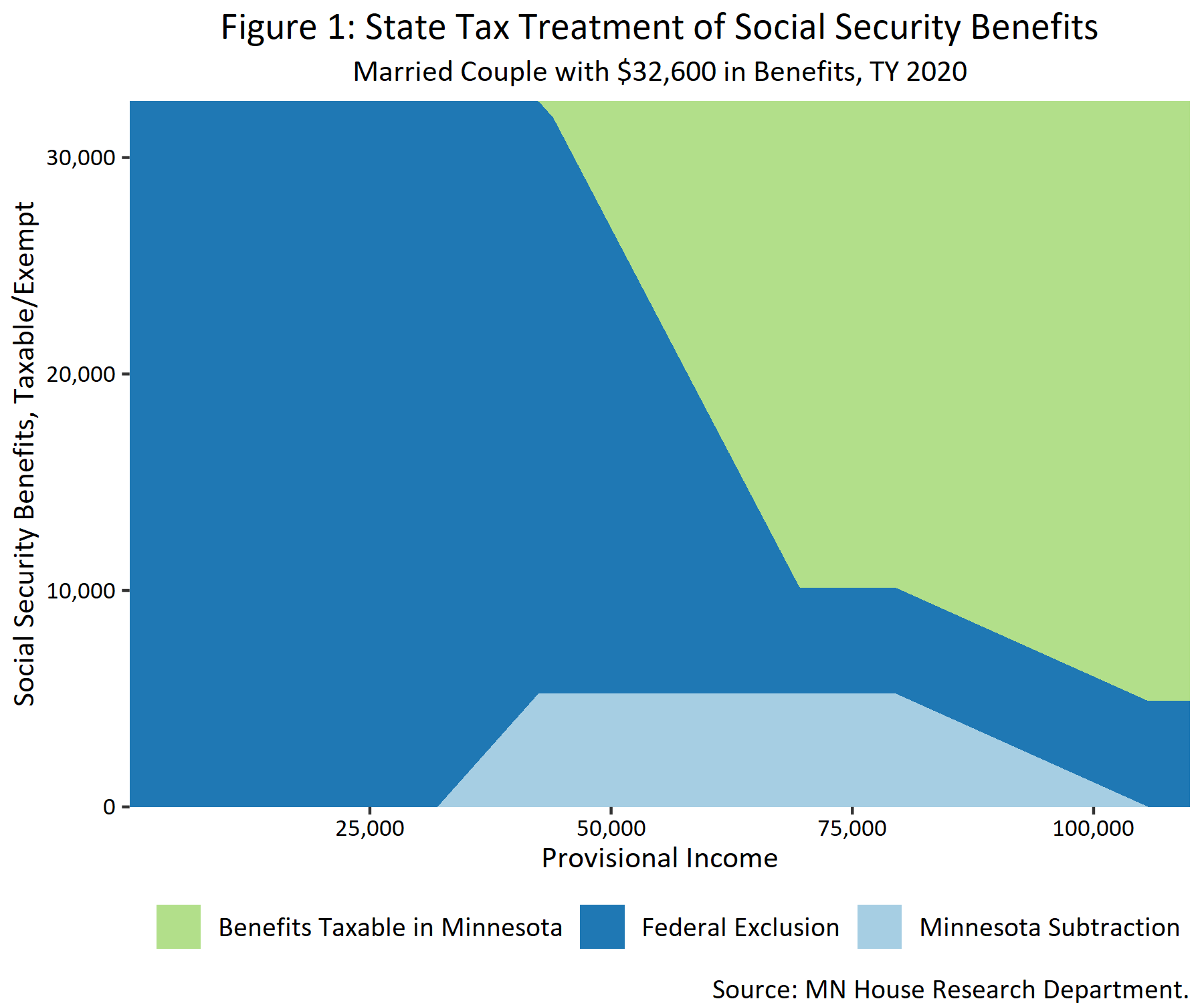

Taxation Of Social Security Benefits Mn House Research

Minnesota Unemployment Relief For Covid 19

Taxation Of Social Security Benefits Mn House Research

State Of Minnesota Passes 2021 Tax Bill Bgm Cpas

Mn Sales Taxes If You Re A Business That Sells Taxable Products Or Services In Mn Whether You File Monthly Or Quart Meant To Be Instagram Posts Sales Tax

Overview Of Minnesota Unemployment Tax Rates For 2022

As State Projects 9 3b Surplus Walz Proposes Increasing Direct Checks To 500 1 000 Bring Me The News

Unemployment Tax Break Update Irs Issuing Refunds This Week Kare11 Com

Mn Dept Of Revenue Begins Processing Unemployment Insurance Compensation Ppp Loan Forgiveness Wcco Cbs Minnesota

Minnesota Tax Forms 2021 Printable State Mn Form M1 And Mn Form M1 Instructions

Mn Department Of Revenue Will Begin Sending Tax Refunds For Ppp Loans And Extra Jobless Aid In Next Few Weeks Wcco Cbs Minnesota

Minnesota Legislature Passes Federal Conformity Bill

Where S My Refund Minnesota H R Block

During 2020 For 1 5 Months I Was In A Different S

Minnesota Salt Cap Workaround Salt Deduction Repeal

Mn Legislature Yet To Reach Deal On Unemployment Insurance Bring Me The News